Citizens Bank Corporate Office, one of the oldest and largest financial services firms in the United States, is headquartered in Providence, Rhode Island. Citizens Bank offers a wide range of banking products and services to individuals, small businesses, and corporations, including savings and checking accounts, loans, mortgages, and wealth management services. This post provides detailed information about Citizens Bank, including their corporate address, contact numbers, and an overview of the company’s services and position in the banking industry.

Citizens Bank Headquarters Address and Phone Number

Citizens Bank Headquarters: An Overview

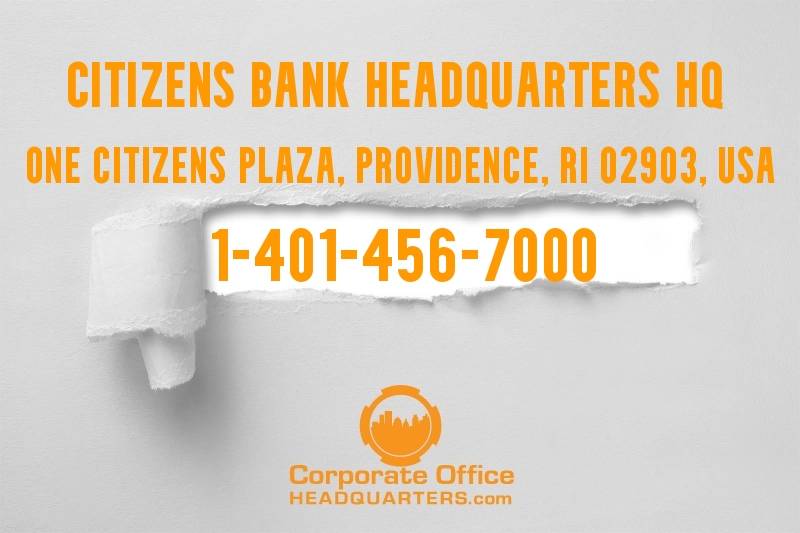

- Corporate Address: One Citizens Plaza, Providence, RI 02903, USA

- Citizens Bank HQ Phone Number: 1-401-456-7000

- Citizens Bank Customer Care: Accessible via their website or customer service line

- Website: citizensbank.com

Maps and Directions To Citizens Bank Headquarters

Citizens Bank’s Role in the Banking Industry

Citizens Bank is a key player in the American banking sector, known for its customer-centric approach and comprehensive range of financial services. The bank has a strong commitment to providing personalized banking solutions and financial advice to meet the diverse needs of its clients.

The Competitive Landscape of Banking Services

In the competitive banking market, Citizens Bank faces challenges from national banks, regional banks, and emerging online banking platforms. Key competitors include Bank of America, Chase, Bank of the West, Truist, and Wells Fargo, as well as smaller community banks and fintech companies. Citizens Bank distinguishes itself with its focus on tailored financial services, community engagement, and a strong regional presence in the Northeastern United States.

Citizens Bank Contact Phone Numbers: An Overview

- Customer Service Number: 1-800-922-9999

- Debit Card Issues: 1-877-242-7837

- Fraud or Dispute: 1-800-922-9999

- Online Banking: 1-800-862-6200

- Home Equity Loans: 1-800-340-5626

- Auto Loans: 1-800-708-6680

- Citizens Pay: 1-888-522-9881

- Citizens Securities: 1-866-919-4520

- Mortgage: 1-800-234-6002

- IRA: 1-800-948-7200

- Students: 1-800-600-0008

- Student Loans: 1-888-411-0266

Citizens Bank Corporate Office Complaints, Reviews, and Feedback

We encourage you to share your experiences with Citizens Bank’s banking products, customer service quality, financial advice, and overall satisfaction with the bank. Your feedback in the comments section is invaluable, providing insights that help others understand Citizens Bank’s operations and commitment to customer service in the banking sector. Whether you have compliments, complaints, or suggestions, your perspectives are important in evaluating the bank’s performance and service quality.

Why Trust CorporateOfficeHeadquarters.com?

CorporateOfficeHeadquarters.com aims to provide accurate and current information on corporations like Citizens Bank. We ensure our readers can trust us for reliable and comprehensive corporate details.

Disclaimer

Please be aware that CorporateOfficeHeadquarters.com is not officially affiliated with Citizens Bank. The content provided is for informational purposes and serves as a platform for customer reviews, feedback, and corporate complaints.